A lot of people are now migrating to computers using the Windows 10 Operating System released at the end of July. Despite the fact that QuickBooks 2014 was released almost 3 years prior to this new Windows Operating System QuickBooks users believe that QB (2014) should run perfectly under the OS from first install. In my own ProAdvisor practice we have been receiving ‘distress calls’ from people using older versions of QuickBooks, especially people still using QuickBooks 2014, who are having problems when they attempt to install those versions under Windows 10. In many of these cases users are having problems installing QuickBooks 2014 and getting it to open, configure or run properly. Our firm has dealt with primarily two specific problems with these client installations.

In part one of this series we examined the first problem we have had reported, Error 3381, -11118 dealing with a corrupted Entitlement Client file. In this article we will look at Windows-10 Permissions Errors which may prevent and/or limit the way QuickBooks 2014 operates under Windows-10.

QuickBooks Pro 2014 - Windows. This item is no longer available in new condition. See similar items below. QuickBooks Pro 2014 Hello all! I just had to purchase a new computer since mine literally died:( and the new one has windows 10. I cannot get my quickbooks pro 2014. Intuit QuickBooks Pro Annual 2014 Product Features. Includes everything in QuickBooks Pro 2014 plus upgrades as they are available 1; Organize your business finances all in one place and save time on everyday tasks; Easily create invoices and manage expenses; Get reliable records for tax time; Step-by-step set up, easy to learn and use. Oct 02, 2020 Hello, We currently use QB-Desktop-Pro-2014 and upgrading to QB-Desktop-Premier-2021. Will we be able to upgrade all files from Pro-2014 to Premier-2021? Which file extensions are needed for the upgrade, currently we have the following extensions:.DSN,.MTA,.LMR,.ND,.QBW,.TLG Thanks. Microsoft Surface Pro 7, 12.3' Touch-Screen, Intel Core i3, 8GB Memory, 125GB Solid State Drive, Platinum, VDH-00001. QuickBooks Pro helps you organize your business finances all in one place so you can complete your frequent tasks in fewer steps.

Windows Permission Errors

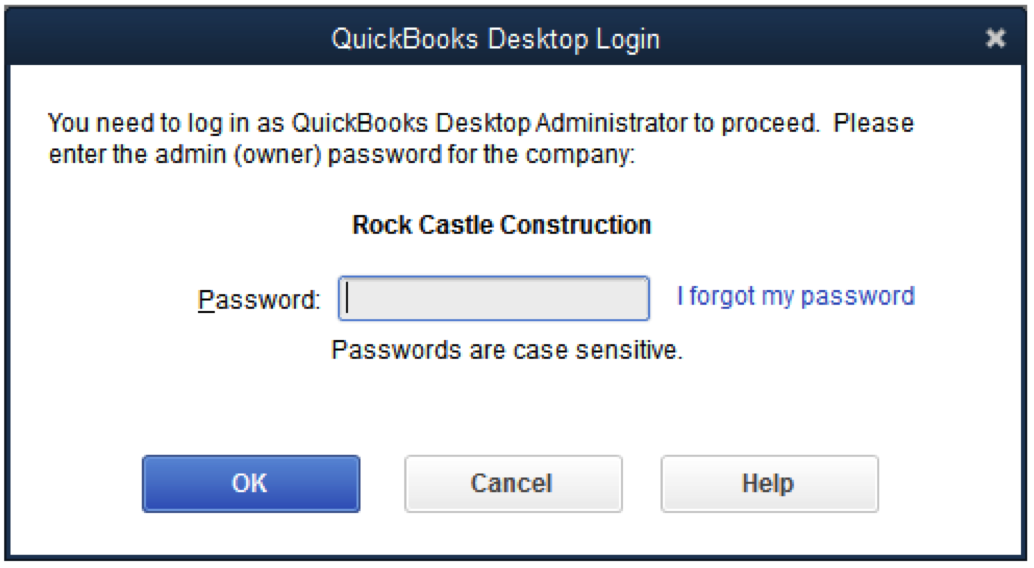

QuickBooks can display a variety of error messages (similar to the one below), all relating to a lack of access to the file (which is the result of insufficient or improper Windows Permissions.)

Errors may be displayed when attempting to open a file, or use a specific feature such as printing, even when the file is already open and in use. In some instances the file may lock-up or become unresponsive without resolution.

Note: While Intuit insists that the QuickBooks 'File Doctor' will resolve all of these problems, we find that it frequently either does not, or only configures a portion of the files properly. Once you have done this a few times, it will probably take the skilled ProAdvisor less time to perform the steps manually for all the affected files than the time required to download, install and run the File Doctor. You would still still need to verify all the files are properly configured after running File Doctor.

Step-by-Step Procedure

These steps instruct how to modify various QuickBooks folders under Windows 10 to ensure they have the proper read/write permissions necessary for QuickBooks to function correctly.

To repair this problem you must be able to access the hidden Windows folder containing the encrypted data. Therefore you must insure that you have set the preference to ‘show hidden files’ in your file display options.

1) Insure that QuickBooks is closed, and that all QuickBooks ‘services’ are shut-down. This may require you to launch Task Manager and shut down all QuickBooks/Intuit services shown under processes.

2) Navigate using Windows Explorer to C:Program Files (X86)

3) Right-click on the Intuit folder and select Properties, and then click the Advanced button.

4) Ensure that the Users group is displayed within the Owner field at the top of the Advanced window. If you see SYSTEM, or anything other than Users, you must take ownership of the Intuit folder.

- To take ownership, click Change for the Owner field under the Advanced Security Settings for Intuit permissions window.

- Type USERS and press Enter.

- Place a check-mark in the Replace owner on subcontainers and objects check-box.

- Select Users (Your Computer Name/Users) Full Control and then click OK.

5) On the Security tab of the Intuit folder properties window click the Edit button.

6) Select USERS (Your Computer Name/Users) and make sure Full Control has a check-mark in it.

7) Click OK to exit the Intuit folder properties window.

8)Repeat the above steps for each of the additional QuickBooks related file folders shown below:

- C:Program Files (x86)Common FilesIntuit)

- C:ProgramDataIntuit

- C:UsersYour User NameAppDataLocalIntuit

Description

| Subject: | QuickBooks |

|---|---|

| Version: | Pro 2014 |

| Level: | Intro through Advanced |

| Topics Covered: | 98 |

| Pages: | 4 |

| Dimensions: | 11 x 17″ – Folded |

| Availability: | Printed & Laminated or PDF Download |

| ISBN: | 978-1-934131-99-2 |

Product Description

Designed with the busy professional in mind, this 4-page quick reference guide provides step-by-step instructions in QuickBooks Pro 2014. When you need an answer fast, you will find it right at your fingertips. Clear and easy-to-use, quick reference cards are perfect for individuals, businesses and as supplemental training materials.

Topics Covered:

The Chart of Accounts

Adding a New Account

Editing an Account

Deleting or Inactivating an Account

Customers, Employees and Vendors

Accessing the Centers

Adding a New Customer

Editing or Deleting a Customer

Adding a New Employee

Editing or Deleting an Employee

Adding a New Vendor

Editing or Deleting a Vendor

Creating Custom Fields in List Items

Quickbooks Payroll

Managing List Items

Creating Item List Custom Fields

Sorting Lists

Inactivating and Reactivating Items

Renaming and Merging List Items

Sales Tax

Creating a Sales Tax Item or Group

Setting Default Sales Tax Preferences

Indicating a Taxable Customer

Indicating a Taxable Item

Creating a Sales Tax Report

Paying Sales Tax

Inventory

Enabling Inventory in QuickBooks

Creating New Inventory Part Items

Creating a Purchase Order

Creating Purchase Order Reports

Receiving Inventory with a Bill

Creating an Item Receipt

Matching a Bill to an Item Receipt

Manually Adjusting Inventory

Other Items

Creating Other Items (Service Items, Non-Inventory Parts, Other Charges, Subtotals, Groups, Discounts and Payments)

Changing Item Prices

Basic Sales

Creating an Invoice or Sales Receipt

Finding Transactions

Previewing Invoices and Receipts

Printing Invoices and Receipts

Price Levels

Creating New Price Levels

Associating Defaults with a Customer

Changing Line Item Rates

Billing Statements

Setting Finance Charge Preferences

Entering Statement Charges

Creating Statements

Payment Processing

Recording a Full Payment

Entering a Partial Payment

Applying One Payment to Multiple Invoices

Entering Overpayments

Entering Down Payments or Prepayments

Applying Customer Credits

Making Deposits

Handling Bounced Checks

Refunding Customer Purchases

Refunding Customer Payments (overpayments, down payments and prepayments)

Entering and Paying Bills

Entering a Bill

Paying a Bill

Applying Early Payment Discounts

Entering a Vendor Credit

Applying a Vendor Credit

Bank Accounts

Entering Transactions in the Register

Using the “Write Checks” Window

Writing a Check for Inventory Items

Printing a Single Check

Printing a Batch of Checks

Transferring Funds

Voiding Checks

Reporting

Creating a QuickReport

QuickZooming a Report

Modifying a Report

Memorizing Modified Reports

Printing Reports

Batch Printing Forms

Estimating

Creating a New Job

Creating an Estimate

Invoicing from an Estimate

Inactivating an Estimate

Making Purchases for a Job

Invoicing for Job Costs

Creating Jobs Reports

Time Tracking

Printing Blank Weekly Timesheets

Using a Weekly Timesheet

Using the Time/Enter Single Activity Window

Invoicing a Customer Based on Time

Displaying Time Tracking Reports

Entering Vehicle Mileage

Invoicing a Customer for Mileage

Payroll

Viewing and Creating Payroll Items

Setting Employee Payroll Defaults

Setting Up Employee Payroll Information

Creating or Editing a Payroll Schedule

Creating Scheduled Paychecks

Creating Unscheduled Paychecks

Creating Termination Paychecks

Credit Card Accounts

Creating a Credit Card Account

Entering Credit Card Charges

Reconciling a Credit Card Account

The Loan Manager

Using the Loan Manager

Quickbooks Pro 2014 Crack With Serial Key

Company Management

Updating Company Information

Using Reminders and Setting Preferences

Making General Journal Entries